Article

September 2023

June 2024

5 min read

Today, attracting and retaining top talent is a key issue for finance leaders and human resource managers alike. Lack of accounting talent is a risk factor and can increase the likelihood of errors as employees become overburdened with workloads. In California, two-year occupational employment projections from the Employment Development Department (EDD) forecast that 15,750 accounting and auditing professionals will transfer out of the occupation while 10,740 will exit the labor force entirely between 2023-2025.

The scarcity of accountants is an increasing problem for material weaknesses reported by public companies. A study conducted by KPMG found that “lack of accounting resources/expertise” was a primary issue documented in annual filings, starting at 34% (2021), growing to 48% (2022), and concluding at 55% (2023)[1]. As accounting professionals depart from their roles, organizations are presented with both the challenge of overcoming volatility in their absence while capitalizing on the opportunity to increase leverage with a new hire.

Human capital is high leverage. Exceptional employees serve as a multiplier for a company’s revenue-earning potential. Thus, ROI is heavily dependent on a firm’s ability to attract and retain top-notch professionals. Emerging AI tools can further enhance the multiplication force of employees by improving efficiency and productivity.

On the other hand, human capital is volatile. Employee turnover occurs in almost all organizations, and transition periods between full-time hires can be protracted and turbulent. Executives should address this potential instability by preparing contingency plans in advance.

High-caliber employees increase leverage for organizations by identifying cost savings and new opportunities for growth. For example, a previous manufacturing client experienced an abrupt vacancy in the controller position and within 24 hours, the Impactful team found an interim controller. This controller proceeded to identify $2 million in expense savings and provided key profitability analysis.

Technology is another source of leverage for organizations, and advances in AI capabilities can be utilized to support essential finance and accounting tasks. Finance professionals can utilize AI to improve forecasting, analysis, and error detection. AI is also likely to start assisting professionals with more robust activities, such as crafting technical accounting memos.

High-leverage professionals are eager to adopt innovative technologies and willing to tackle projects outside of their core competencies. Candidates who take the initiative to use A.I. to support their role demonstrate curiosity, innovation, and drive. Furthermore, candidates who volunteer to work on projects outside of their regular scope will possess a more diversified skill set.

Top employees are usually disinterested in accepting new roles that mirror their current duties because their primary motivations are to increase job responsibilities and secure growth opportunities. This is where gap analysis comes into play. In gap analysis, interviewers aim to understand the “as is” and “to be” state of a candidate to determine if an interviewee can successfully meet future KPIs. Since high-achieving professionals are unlikely to accept a lateral move, it is the responsibility of the employer to articulate the growth trajectory of a role. Before attempting gap analysis, employers should have a clear vision of the role and understand its impact on the organization. Top-notch employees are attracted to roles that enable them to be impactful.

A key to retaining high performers is to match the ambition of a candidate to the growth of the role. It is not enough for employees to buy-in to an organization’s future, they must also buy-in to their future at an organization. Top talent will move on if they no longer feel challenged by their tasks or if they do not have a clear understanding of growth within a company.

Career employers are few and far between in today’s business landscape. Recognizing that not every organization is the final destination for its employees, it is vital that employers communicate their employee value proposition (EVP) to team members. An EVP describes the value a company provides in exchange for employee’s work contributions. This value and can extend beyond compensation and benefits to include internal growth opportunities and mentoring. Unfortunately, it is not always possible to retain high-leverage team members. An untimely departure can have an adverse effect on performance if businesses are unable to swiftly backfill vacant positions.

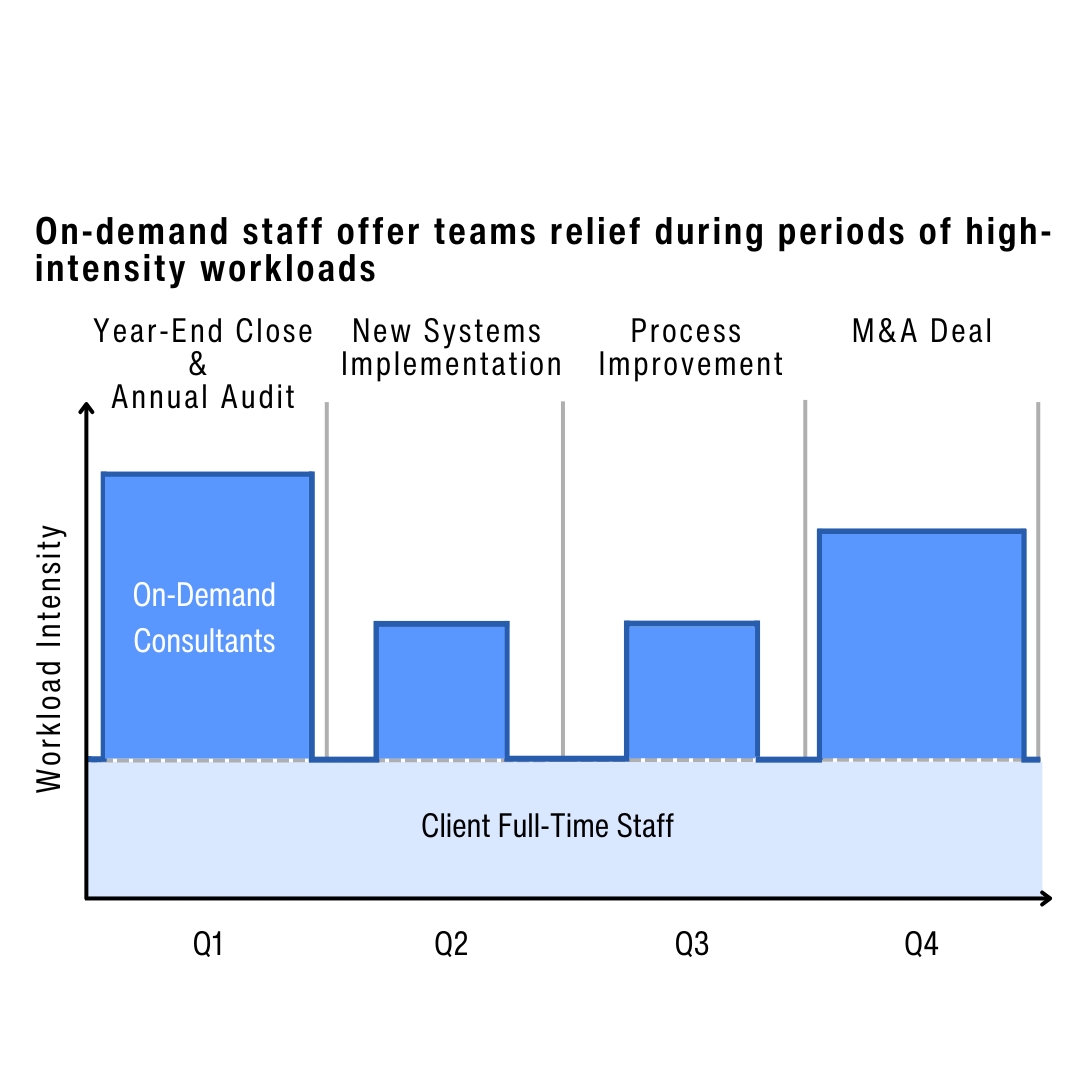

Complex talent challenges require creative workforce strategies. The market rate of direct-hire accountants is rising due to inflation and limited supply. To attenuate this challenge, businesses can employ on-demand consultants. On-demand talent offer cost-effective and essential interim relief to boost performance in periods of heavy workload.

Whether a firm needs assistance with year-end close, an annual audit, a recent M&A deal, process improvement, or a new systems implementation, project consultants can optimize operations by providing additional workload capability and capacity.

Faced with accounting shortages, CFOs are tasked with reducing risk from employee turnover and maximizing leverage with top talent. By employing the appropriate resources, organizations can confidently navigate all market conditions and find leverage even during periods of volatility.

Locally owned and managed since 2012, Impactful Resources is a leading provider of accounting, finance, and IT resources based in Southern California. As a full-service human capital firm focused on supporting emerging growth and middle market companies, we help firms scale to meet the needs of rapidly changing market conditions. Whether the solution is a special project, interim back-fill, or a permanent placement, Impactful Resources can satisfy a wide range of client needs.

[1] Trends in material weaknesses. KPMG. (2023).